25 June 2024, Sydney: LoanOptions.ai, Australia’s fastest-growing personal, car, business and equipment loan comparison platform and broker, has introduced a bank statement analysis tool to help its customers track their spending.

9 October 2024, Sydney: LoanOptions.ai, Australia’s leading loan matching technology provider and broker, has teamed up with Occubuy, the country’s pioneering reward platform for renters, to empower Australians in tackling personal debt.

19 October 2023, Sydney: Australia’s fastest-growing ‘neobroker’ disruptor LoanOptions.ai is expanding its service to New Zealand as the country’s first-ever loan comparison platform powered by AI.

Leading loan comparison disruptor propels to new heights with new version of app that cuts application time in half!

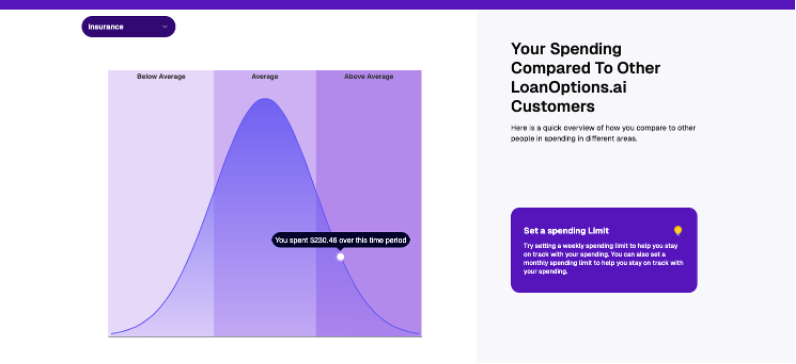

LoanOptions.ai, Australia’s fastest-growing personal, car, business and equipment loan comparison platform and broker, has introduced a bank statement analysis tool to help its customers track their spending.

In what was our First Full Financial year (we launched in August 2020), I thought I would share a quick summary of LoanOptions.ai.

Our team has been busy, today we are launching our LoanOptions.ai white labelled application journey. We can deploy this loan application journey on any website (even if your current one is old) and in any colours that suit your brand.

The easiest way for our customers to have full transparency on where their application is up to. No need to create an account or remember a password. They will be able to make direct contact with the broker who is handling the file.

Want to find the right loan with fairness, accuracy and speed? Believe it or not, not everyone gets the best loan. Not everyone knows how to. That’s why at LoanOptions we have made it our mission to get you the best and MORE.