The Occubuy Rent App is redefining what it means to be a renter in Australia. By offering tangible rewards for rent payments, Occubuy pioneers in bridging the gap between renting and owning a home, making home ownership more accessible.

Occubuy rewards Australian renters for paying rent with credits that go towards buying their first home, turning their monthly obligation into a stepping stone towards their ultimate goal.

Since its launch in 2021 the platform has helped thousands of Australians to save, manage, and earn more money while working towards the goal of home ownership.

Occubuy is more than an app to keep track of rent payments. It's a rental mobile app that turns ‘dead rental money’ into money that works towards your home ownership dream.

The way this works is through its First Home Buyer Rewards Program: which gives credits you can redeem with third-party Property Partners with every rent payment.

Through our new partnership, personal loan borrowers will soon be able to also get credits and rewards for every repayment on their personal loan.

As a borrower, you will be able to reap the benefits of not just cutting-edge technology and automation to find the best loan for your circumstances, but also to help you make loan repayments and better financial decisions that build up your credit score.

The date is yet to be confirmed. We’re still working out the kinks for these technological changes together across platforms.

From the way things are currently going, we’re estimating that you will be able to start earning rewards off your personal loan repayments before the end of this year (2024).

We know that with the rising cost of living and house market costs, it’s gotten harder to make the lifestyle purchases or loans you want.

It’s not just a feeling either, we’ve done the research and you can see it in the figures today:

31% of Australians or 2.9 million households are renters, according to the Australian Institute of Health and Welfare.

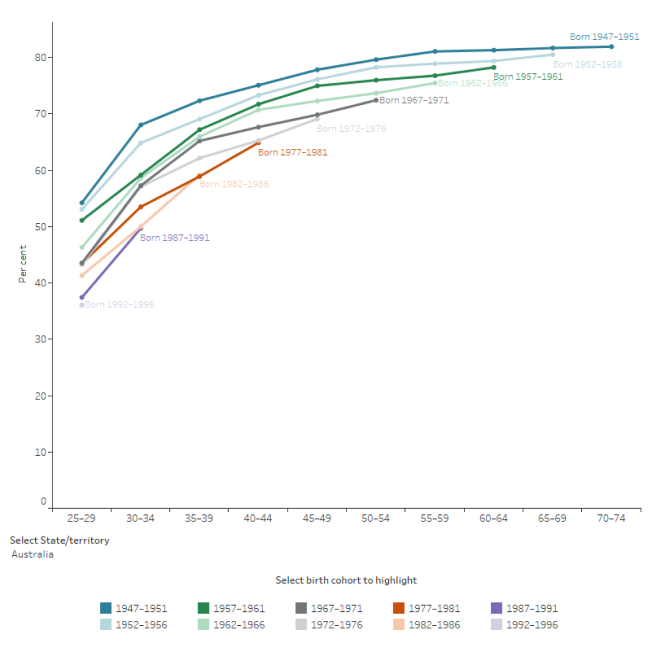

Home ownership has gradually been decreasing down the generations.

Just a little over half of Millennials in Australia (those aged 25 - 39) are homeowners. Compared to 62% of Gen X and two thirds (or 66%) of Baby Boomers at the same age.

Living in Sydney is also particularly expensive if you’re a renter.

Finder has found that the state with the highest cost of rent is Sydney, with the median rent cost for a house being $750 and $675 for a unit. If we’re speaking in percentages, renting a house in Sydney costs 39% of average weekly salary, or 35% if you’re renting a Sydney unit.

As a company that’s invested in putting the power of individuals’ finances back into their hands, we’re excited for the new good things in store that will be available for Aussie personal loan borrowers through this partnership.

Our goal for this isn’t to get more people to start new personal loans. It’s here to help our users reduce their existing debt repayments as much and as quickly as possible which will in turn allow them to improve their financial wellbeing.

Choose from a variety of methods including direct debit, credit/debit cards, PayTo, BPay & more, with Occubuy credits for each payment. With every repayment, you’ll get credits that you can use to boost your home deposit.

Learn to track your recurring expenses to save more towards your deposit. Occubuy also provides personalised assistance for saving, paying off debt and improving your credit score.

Free credit score check in the palm of your hand. Improve and manage it, all the way to the bank!

Get help both navigating the government’s First Home Buyers Grant and applying to accelerate towards home ownership. There’s additional resources for buying off the plan, and family guarantor options.

Stay connected with LoanOptions.ai blogs and social media channels.

Are you a like-minded business or broker looking to get on board our mission of financially empowering Australians? You might like to consider becoming an affiliate partner.

If you have other ideas on how our proprietary loan matching AI technology can help empower your customers, you can also call us on 1300 060 684 to discuss collaboration.

Still have questions?

If you have any questions or enquiries,

visit our FAQ bunker or give us a call

Taking out a loan, even for a small amount, can be costly and may not resolve your financial issues.

Explore your alternatives before deciding to borrow.

For guidance on managing bills and debts, you can speak with a free and independent financial counsellor by calling 1800 007 007 from anywhere in Australia. Reach out to your electricity, gas, phone, or water provider to discuss possible payment plans. If you receive government benefits, check with Centrelink to see if you’re eligible for an advance: Phone: 13 17 94.

Visit the Government’s MoneySmart website for details on how small loans work and to explore other potential solutions.

This notice is required by the Australian Government under the National Consumer Credit Protection Act 2009.